If you are knee-deep in debt, you might discover that you are worried as well as also a good night’s remainder is difficult to do. The anxiety of this concern makes you nervous to do something to do away with it, yet it might be difficult to know where to start. Before you find yourself completely helpless, have a look at your choices as well as jump on the path out of this credit history problem.

Essentially, you have 2 alternatives … You can get out of debt on your own, or with the help of a professional. Either way, the crucial thing is to begin currently pursuing leaving debt. Here are some tips for those who wish to discover their way out of financial debt on their own.

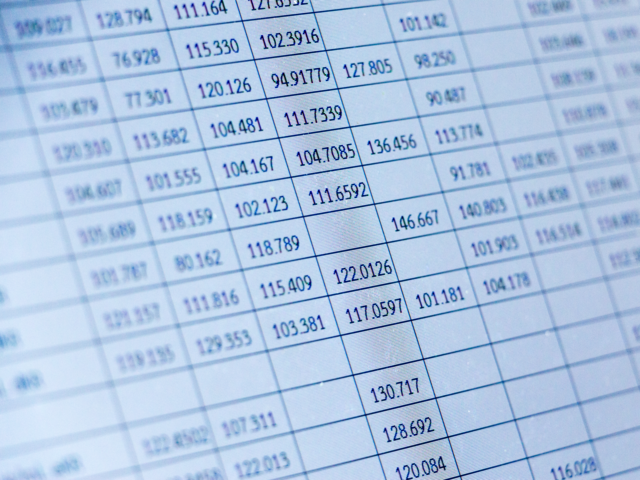

First list all the debts that you owe. You will require to provide all the information regarding each financial debt such as info concerning the lender, quantities, and also your account number. Then consist of the arrangement that you authorized when taking the finance. Every one of your financial statements must be easily accessible and in a safe as well as secured spot.

As soon as you have your checklist, take some time to arrange all your documentation. At the top of your list will be any type of financial debt that have collateral, such as a home loan or various other large lendings. Those for which you are legally bound must be high on your list of priorities too. Debts that can go lower on your listing would be the extra small bank card kind of financial debt. Still, those ones need to be dealt with too, as you can be demanded lack of repayment.

When your listing remains in the location you are ready to get going on your budget. This is a really standard and also important part of leaving debt as well as must not be too tough to do. Nevertheless, you never ever take your budget plan lightly, because used appropriately it’s an extremely efficient device to obtain you out of financial obligation.

Initially, write down all your earnings and also expenses. As soon as you have your spending plan all set, you can take a look at your focused list of financial obligations. You can determine what to repay very first and look at what quantity you can produce each repayment to get rid of that financial debt immediately. When you have all of it identified, you might find that you have a little leftover to save. This is an extremely wise suggestion as it will aid you on the path to reform from your lavish investing practices and maintain you from finding yourself in another economic mess.

While you are getting this all found out, a few of your creditors may end up being restless, and also there’s an opportunity that they might inform you that they are considering taking a lawsuit. In this case, you need to call them and also ensure them that you are doing everything you can. Let them understand about your new strategies and that you will be making routine repayments from here on out. If you get along and are also positive, they will likely trust your honesty and they will certainly permit you to move on with the business of repaying your lending.

Taking these actions you will find yourself in the pleasing setting of being financial debt totally free in a relatively short time, in contrast to simply letting your unpaid bills accumulate while you worry over them. A positive strategy is absolutely the way to go when your knee is deep in the red. Check out the full report on dealing with money problems in this link.